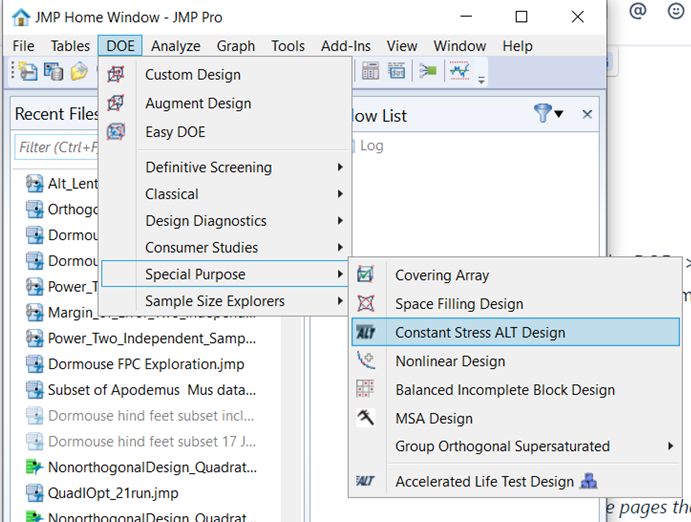

Hoping your products are too good to fail? Find out using JMP® 18 Constant Stress Accelerated Life Test (CSALT)

To predict the reliability of some parts or products, the time and resources required to test under normal conditions isn’t practical, because it could take years for a failure to occur. Instead, eng...

gail_massari

gail_massari

Peter_Hersh

Peter_Hersh

Masukawa_Nao

Masukawa_Nao

Jed_Campbell

Jed_Campbell

Phil_Kay

Phil_Kay

Bill_Worley

Bill_Worley

DaeYun_Kim

DaeYun_Kim

SamGardner

SamGardner

Valerie_Nedbal

Valerie_Nedbal

Richard_Zink

Richard_Zink

KristenBradford

KristenBradford

Chris_Kirchberg

Chris_Kirchberg

cweisbart

cweisbart

Paul_Nelson

Paul_Nelson

Craige_Hales

Craige_Hales

anne_milley

anne_milley

Di_Michelson

Di_Michelson

JohnPonte

JohnPonte