- JMP will suspend normal business operations for our Winter Holiday beginning on Wednesday, Dec. 24, 2025, at 5:00 p.m. ET (2:00 p.m. ET for JMP Accounts Receivable).

Regular business hours will resume at 9:00 a.m. EST on Friday, Jan. 2, 2026. - We’re retiring the File Exchange at the end of this year. The JMP Marketplace is now your destination for add-ins and extensions.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discussions

Solve problems, and share tips and tricks with other JMP users.- JMP User Community

- :

- Discussions

- :

- Re: How to optimize factors with uncertainty in 1 step with JMP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

How to optimize factors with uncertainty in 1 step with JMP?

Hello community!!,

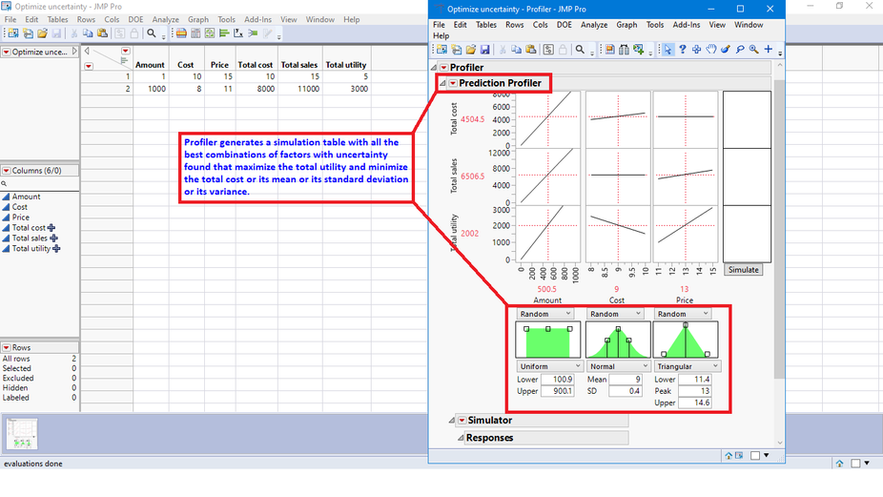

A question: will it be possible for the profiler to find the best combinations of factors with uncertainty when performing a simulation, which maximize the total utility and minimize the total cost, generating a table of the best combinations found? For example:

- Tags:

- windows

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

I'd ask you to clarify what you mean by "optimize." Are you trying to achieve the best result on average? Or are you trying to find a compromise between best average response and low response variability?

When you choose "Maximize Desirability" in the profiler, JMP will find you the optimal mean response like @Mark_Bailey said. Variability or uncertainty in the factors does not come into play here.

If you have uncertainty in the factors, then you might be concerned about how that uncertainty impacts response variability as well as the mean response. The Design Space profiler that Mark mentioned is suitable for exploring this when you have spec limits. When you do not, you could try a simulation experiment.

Simulation Experiments work nicely when you have spec limits and defect rates, like the example in the video. But even in the absence of spec limits you could look at mean and standard deviation of your response variable at different factor settings. It's up to you to select factor settings that have an acceptable tradeoff of desirable mean response and low response variability.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

Hello Jordan,

I'm glad to greet you, I use Google Translate and it seems it can't explain my question well, I'll try to be a little more specific.

Note that specification limits should not be used.

Based on the example in the image below, I would like to know if there is a way for JMP in 1 step to optimize the 3 outputs (total cost, total sales and total profit), that is, find the quantity or the mean or deviation standard or the optimal variance of the simulations, for example that JMP in 1 single step generates 10,000 simulations of the 3 factors with uncertainty and the desirability profiler minimizes the total cost, finds the optimal one close to 6,500 USD of the total sales and maximizes the total utility, then generate a table with the best scenarios found, for example that the user can indicate that JMP places in the new table the 5 or 20 best optimal scenarios found by the desirability profiler.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

Hi Jordan,

Thanks for your response, a question... is there a way for the Simulator and Design Space profiler to have the option to optimize (maximize, minimize, find 1 objective or range, none) in 1 single step of the means or standard deviation of the responses (outputs)?

Greetings

Marco

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

Hi Marco,

In short, no. There is not a way to do all this in one step. The reason you can't do it all in one step is because there are many choices to make which will influence your result.

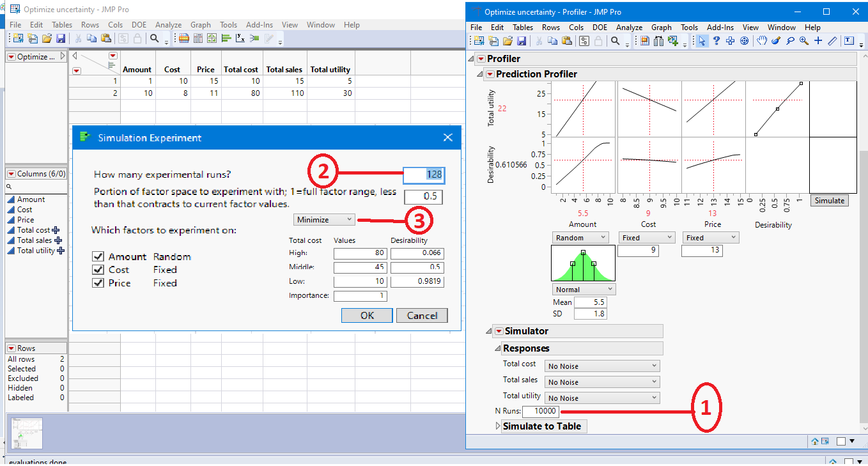

For the simulation experiment solution I suggested above, the steps are roughly:

- Define or fit your model

- Run the profiler and set the desirability function for each response

- Turn on the simulator and select distributions for the factors you wish to vary

- Run a simulation experiment and explore the results to see which factor settings satisfy your needs.

The process above requires careful selection of options at each step, I don't think it could be simplified any further.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

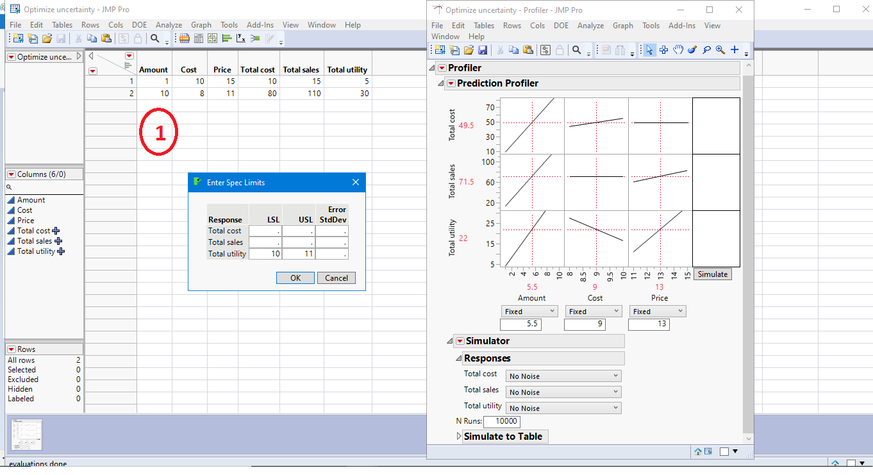

Hello Jordan,

I don't understand your answer, could you please apply your answer using the example I sent (Optimize uncertainty table)?

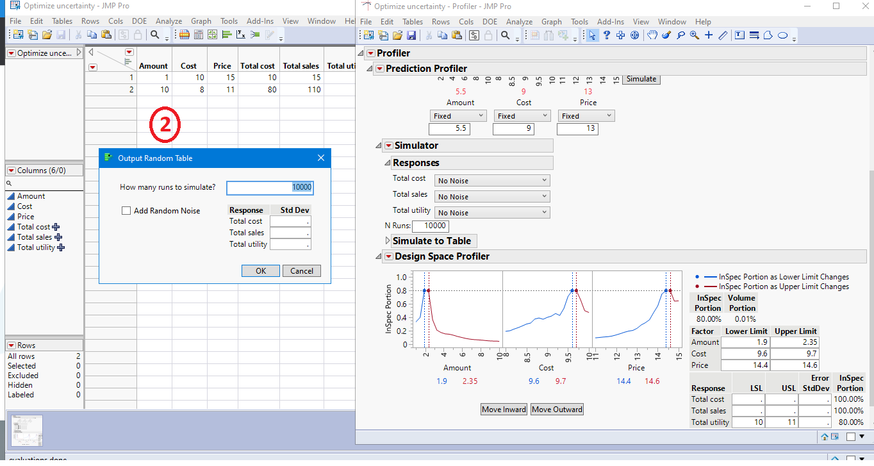

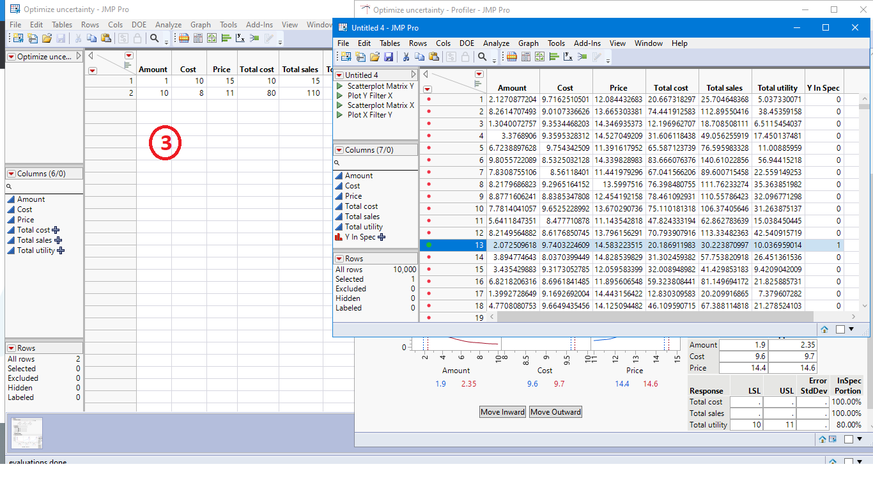

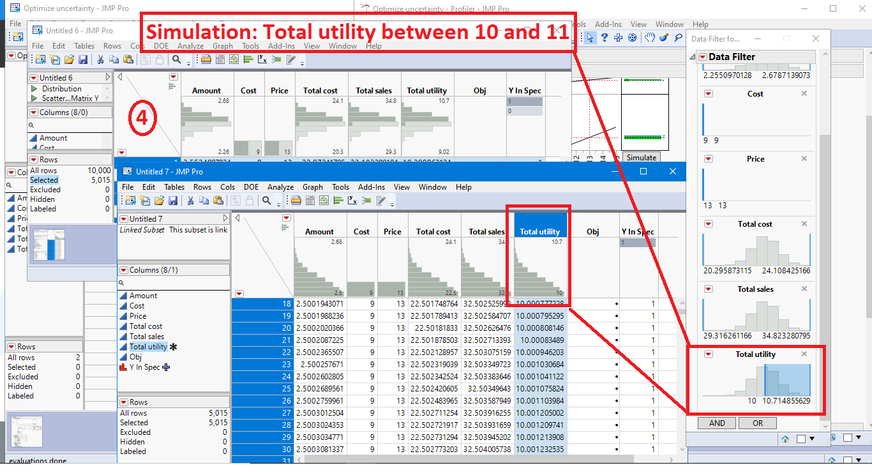

A query....what is the difference between using the simulator and the design space profiler? For example, in the design profiler I put "Total utility between 10 and 11" and run 10,000 simulations, then I generate the table of the 10,000 simulations and I find the "Total utility between 10 and 11", then in the simulator I generate 10,000 simulations with the same data and use the filter to find the "Total utility between 10 and 11", I'm sure I'm missing something but I can't see the difference between using the simulator and the design space profiler.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

Hi Marco,

I'll try to illustrate the process using your example data, or data that is similar. I'll get to that later today.

First let's address the other question: What is the difference between the simulator and the design space profiler?

As you noticed, both the simulator and the design space profiler are doing similar things. The difference is in the uses.

The simulator is a descriptive tool. For a given set of factor setpoints and a specified amount of uncertainty in the factors, it shows how the system would perform in the long run. One can make changes to the factor setpoints and/or the distributions, and see the effect on system performance. If there are spec limits on the responses, then performance can be described as the expected proportion of responses that will be within the limits.

The design space profiler also uses simulation, but the focus is different. It allows users to ask, "how should I set limits on my factors, to ensure that the proportion of expected responses falling within the specification limits is acceptable." Note that we are talking about two kinds of limits: we change limits on the factors to examine performance against spec limits on the responses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

Hi Marco,

After looking more closely at the model you provided, I think I know why we are having a hard time communicating about this.

The model you shared is this one from the profiler documentation. It is meant to show how to use the simulator to add uncertainty to the input factors and see the likely range of outcomes.

The question that started this discussion was “How to optimize factors with uncertainty in one step?” The answer is, as @Mark_Bailey suggested at the outset, the same with or without uncertainty in the factors: simply set and maximize the desirability function for profit. When you follow that procedure for this example, JMP suggests that you should have high unit sales, high unit price, and low unit cost to maximize profit. (Let’s ignore that this simplified model omits the relationship between unit price and unit sales, a.k.a. supply and demand). You didn’t even need to use the profiler to arrive at this conclusion, it should be obvious from the equation.

So what good is it to add uncertainty to the factors? What extra insight does that give you? Used in conjunction with the simulator, it allows you to forecast what the likely outcomes will be at a given set of factor settings. It’s not about optimization. It’s about helping you understand the implications of optimization that you performed previously.

It’s true that there is some subtlety about choosing between factor settings that maximize the mean expected profit and those that minimize the variability of expected profit, and those considerations might lead you to use the design space profiler and/or the simulation experiment features in JMP. But I think those considerations are not what you were really asking about.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

Hello Jordan,

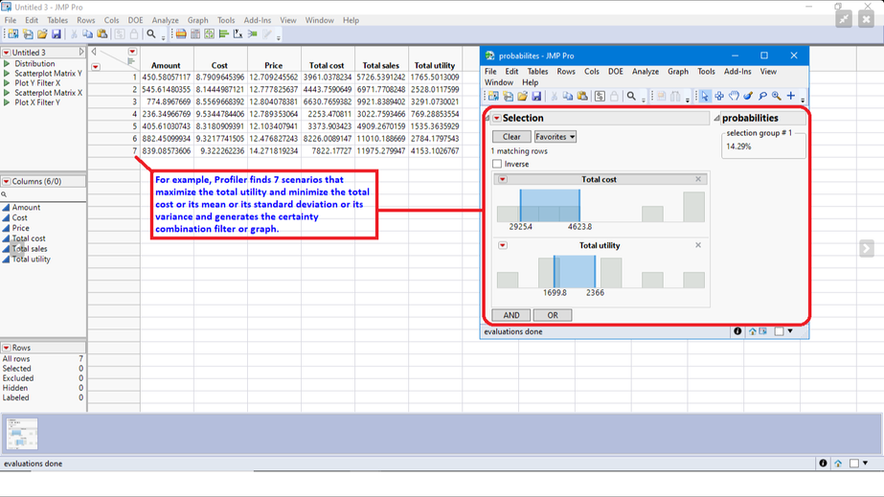

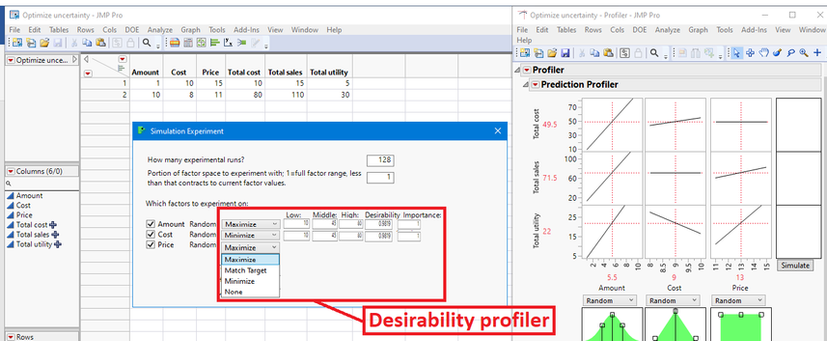

Thank you for your response, I use Google Translate and apparently it does not translate well from Spanish to English and the opposite......I was testing the simulation experiment (without specification limits) and apparently in just 1 step it makes 2 processes, the third process that would be missing... based on the example... is to minimize the total cost or its mean or its standard deviation, minimize the total sales or its mean or its standard deviation and maximize the total utility or its mean or its standard deviation... (3 processes in 1 single step), it would be great if the simulation experiment had the desirability profiler option so that the user can select maximize, minimize, find a value or none , the importance and weights of the mean response or standard deviation or the value of each output and generate a table with the best 1 or 2 or 3 or x answers found.....maybe someone who masters Scripting Language, or JSL I achieved.

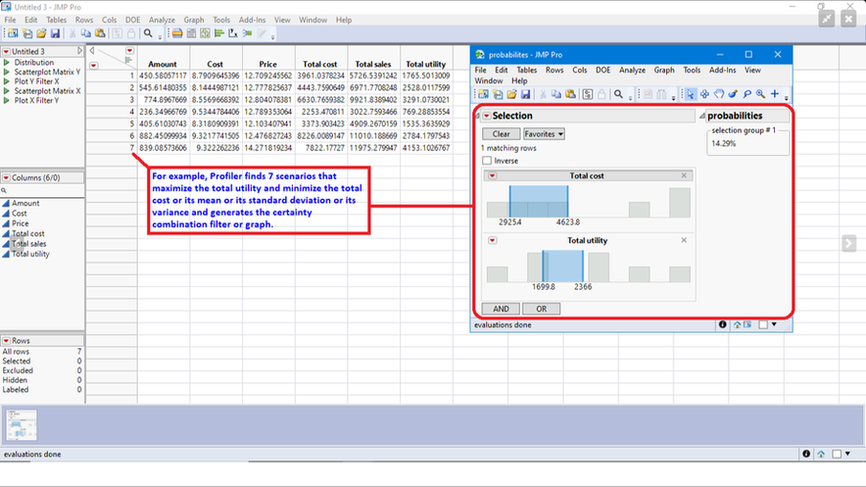

For example, the idea would be something similar to this:

For example 7 best answers found by JMP:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

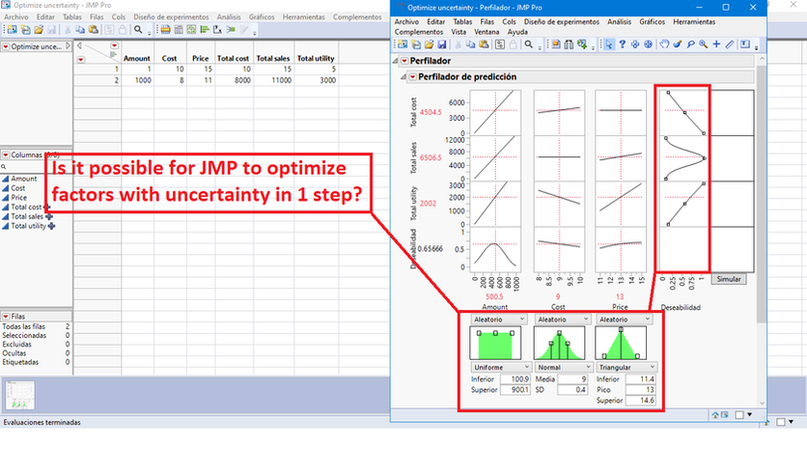

Hi Jordan,

The following image better describes the idea I am referring to about including the desirability profiler in the simulation experiment:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Get Direct Link

- Report Inappropriate Content

Re: How to optimize factors with uncertainty in 1 step with JMP?

With the desirability defined, click the red triangle next to Prediction Profiler and select Optimization and Desirability > Maximize Desirability. The variation in the factor settings is irrelevant to the search for the optimum factor settings.

Recommended Articles

- © 2026 JMP Statistical Discovery LLC. All Rights Reserved.

- Terms of Use

- Privacy Statement

- Contact Us