- JMP User Community

- :

- Blogs

- :

- Scott Wise

- :

- What is the Blue Banana and Why Does it Still Matter for Europe? (Using Graphs a...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Editor’s Note: This monthly blog from Scott Wise, JMP Principal Engineer, seeks to find interesting uses of statistical discovery to solve deep questions dealing with topics around business/economics, sports, history and psychology. Our August entry unravels the myth of the Blue Banana and how it still plays a huge role in European economic performance!

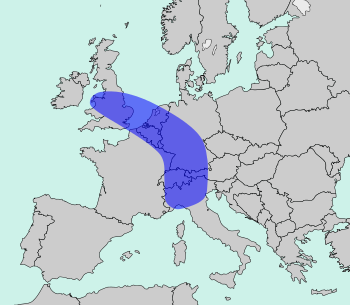

On a recent trip with my family visiting the Rhine River area in Germany we came across a huge outdoor wall mural depicting a large blue banana! It struck me as an odd thing to find in a modern and orderly city like Cologne. Upon a little further research, we found out that this wasn’t just a sporadic artistic statement! The Blue Banana actually refers to a non-continuous swath of Europe that contains the highest concentration of population, industry and wealth. Often called the"Backbone of Europe" it makes a crescent shape that is actually visible from outer space due to the dense grouping of city lights at night. Roger Burnet, a Geographer in France created the concept of the Blue Banana. Purpose was to show his government the need to create more trade corridors with this more active part of Europe and not fall into excessive centralization only in and around Paris. But once journalist got ahold of the term, the Blue Banana became a popular regional identity and a successful marketing tool.

Much has changed in Europe over the past sixteen years. Over that time the European Union (headquartered in Brussels) rapidly expanded membership and has become the major politico-economic force in Europe. Also other patterns of European growth have emerged, such as the growth of technology investment in Southern Europe and the opening of Eastern and Central Europe to manufacturing and services outsourcing. This has lead many to announce that the Blue Banana is dead and other patterns have emerged to replace it (Like in this article: No more Blue Banana, Europe's industrial heart moves east | Reuters). But recent economic problems in Southern Europe coupled with worries of recent slow downs in Central and Eastern Europe economic expansion may not paint so rosy a picture. So if we look at the most recent economic numbers, can we still see a Blue Banana effect and does this area still matter for European economic prosperity?

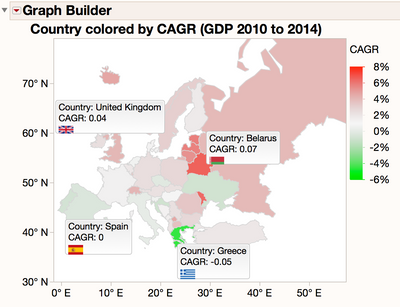

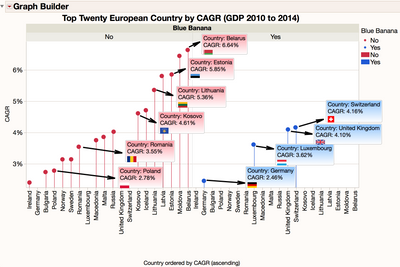

First let's look at growth on a country-by-country basis. We got at a list of nominal GDP (Gross Domestic Product) for European countries (in billion USD) from the International Monetary Funds: World Economic Outlook Database, April 2015 edition. We took the last five years of GDP growth (from 2010 to 2014) and plotted them on a map and a bar chart using the popular financial metric CAGR (Compound Annual Growth Rate) to get a comparable measure. The growth patterns are striking and show highest growth in the newly opened Central and Eastern Europe, slower growth in Northern and Western Europe, and very little growth at all in Southern Europe! This would hold true with the recent press releases lauding the gains made in former communist countries in Central and Eastern Europe, while highlighting the extremely difficult financial debt situations in Southern Europe. See the graphs below for a map and chart showing country-to-country CAGR GDP growth.

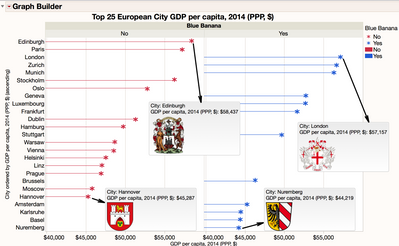

However there are some disadvantages in how we are comparing GDP between countries in the above graphs. First of all the relative size countries being compared varies drastically, especially when looking at overall GDP output. For example Germany overall GDP (ranked #1 in 2014) was fifty times larger than fast growing Belarus (ranked #25 in 2014). So perhaps there is a fairer way to normalize for GDP contribution (perhaps looking at GDP per capita which is GDP divided by midyear population) and further honing in on the contributions of the cities inside and outside the Blue Banana zone. This data was found in the: Global Metro Monitor | Brookings Institution. So we looked at the top twenty-five European cities by their reported GDP per capita for 2014. What you can see in the graph below is that twelve cities in the Blue Banana (nearly fifty percent) were among the top twenty-five cities listed with the highest GDP per capita! Also it was notable that even the cities outside the zone were geographically close to the Blue Banana!

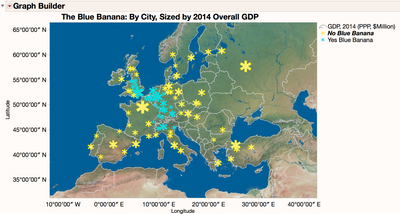

So maybe the Blue Banana, representing this backbone of Europe, still matters! Looking at a map of the overall GDP strength by European Cities below, you can even visually make out the shape for yourself. Several historians once noted that the rise of Europe as a colonial super power came down to intense competition (among nearby autonomous kingdoms/countries), plentiful resources (large workforces and raw materials), and trade access (centralized location to ports, rivers, routes, etc.). Perhaps this explains in a small way why this is still an important region and continuing to shape performance in Europe even today!

Therefore while things are continually changing and growth is occurring in new areas in Europe, look for the Blue Banana to continue to be a large driver of European economic prosperity for some time to come! For more information on how to create compelling graphs and maps with images in JMP, please see the following links in our JMP User Community: For Maps Mapping in Graph Builder and for Images Data Table Blue Birds.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- © 2024 JMP Statistical Discovery LLC. All Rights Reserved.

- Terms of Use

- Privacy Statement

- About JMP

- JMP Software

- JMP User Community

- Contact