This blog by Scott Wise, JMP Technical Manager, seeks to use analytics to answer interesting questions that occur all around us. In this installment, we will use the latest visualization methods to look at the question “Where in the world is my coffee?”

Coffee has gone in this country from being a cheap every-day hot caffeinated beverage to becoming a trendy expensive drink. When my father worked as a boy at the local drug store soda counter, a bottomless cup of black coffee was around 25 cents. Now coffee houses extoll the virtues of different types of coffee varietals, country of origins, and roasting types. This effort to offer a more sophisticated taste has raised the price of a coffee, often two to three dollars for a large coffee. However, as we are made more aware of where our coffee comes from, we mostly only see coffee originating from a handful of large producing countries such as Brazil, Indonesia, Columbia, Jamaica and Kenya. Even Frank Sinatra sang in his famous 1946 “The Coffee Song” that “they’ve got an awful lot of coffee in Brazil!” But it turns out that coffee is easily and readily grow in any country close to the Equator (in between the Tropics of Cancer and Capricorn). So why don’t we get coffee from a wider range of countries around the world?

During a recent trip to my tropical fruit farm in the Philippines, I saw large amounts of native coffee being growing and even drying on the sides of the road around the foothills and mountains of my province. There are four main coffee varietals used for this favorite beverage, mainly Arabica, Liberica (Barako), Excelsa and Robusta. All four types can grow in the Philippines and my province is especially known for its style of Barako coffee and was even rumored to be a world leader in exports back in the Spanish colonial days. If you are lucky enough to taste this type of coffee, you would find a flavorful coffee that is somewhere between the usual Arabica and Robusta versions we typically drink in the USA. So, I asked where I could find this coffee in Texas from a local specialty coffee buyer who procures and roasts coffee from around the world. He indicated that I wouldn’t find this type of coffee exported here and that we tend to only see coffee from the same small batch of the countries due to three things: Price, Quality and Distribution. Basically, a country wanting to export coffee must be not only efficient at the processing and exporting of bulk coffee, but they must also be able to maintain consistent quality at a competitive price. In the case of the Philippines, he indicated that while he had experienced some good coffee from this region, there was too much variation in quality to go along with the higher cost and export issues.

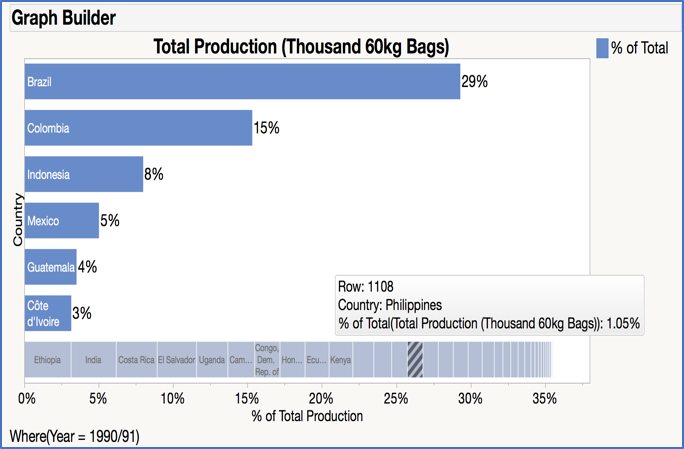

To check this out visually, we found historical coffee production data from 1990 in the historic data archives supplied by the International Coffee Organization (http://www.ico.org/new_historical.asp). To best visualize this data, we utilized a special type graph called a packed bar chart. This graph lets us combine elements of an ordered bar chart and a tree map to better show perspective among all the categories in the chart. For more info on Packed Bar charts, check out Xan Gregg’s blog “Introducing Packed Bars, a New Chart Form: (https://community.jmp.com/t5/JMP-Blog/Introducing-packed-bars-a-new-chart-form/ba-p/39972)

In the first chart below you can see that in the 1990/1991 growing season that of the top six largest blue bars, Brazil was indeed the largest producer, followed by Columbia, and then Indonesia. The last gray bar is the “packed” stack bar part and lets us see how even the smallest countries stand up to the bigger contributing categories. The shaded bar in the “packed” stack is where the Philippines fell among all the exporting coffee countries at only 1.05% of total export production.

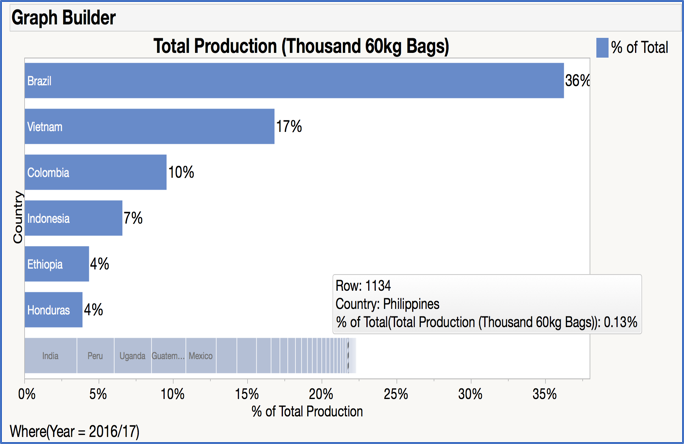

If we reproduce this chart for the 2016/2017 growing season, we can now see that while Brazil remains the largest blue bar, Vietnam has now grown in production and replaced Columbia as the number two producer. In the gray “packed” stacked bar, the Philippines has decreased to only 0.13% percent of the world production.

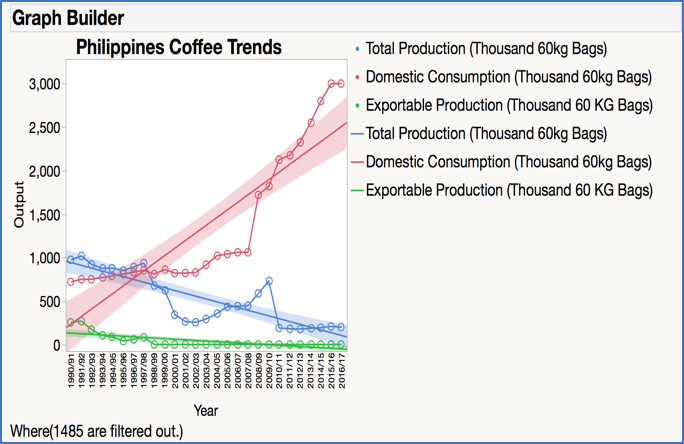

Some further research showed that there was a time in the late 1800s when the Philippines out produced even Brazil and was the largest coffee exporter in the world. But changes in world politics, export prices, and even the effects of crop diseases dramatically reduced coffee farming in the country by the 1900’s. As you can see in the trend chart below, the Philippines (like the USA and Europe) has now become a net coffee importer to satisfy an ever-increasing demand as seen in the domestic consumption trend. Unfortunately for us, what little production is even produced today stays in this country and is readily consumed by the local market.

However recently there have been efforts to help revitalize the industry by bringing back and exporting unique coffee from the Philippines and other lesser known coffee producing countries. These special boutique coffee offerings are finding a growing demand across the world as coffee tastes mature and can support a higher price point to grow and export this small batch, high quality product. So, hopefully soon you can enjoy a nice warm cup of Filipino Barako coffee at your local coffee spot! And then in the words of Bob Marley we can all sing… “One cup of coffee, then I'll go.”

See the raw data and scripts to try out these visualizations for yourself at the following link in our Same Data section: Coffee Stats Data for Trend and Packed Bar Charts