JMP is Pythonic! Enhanced Python Integration in JMP 18

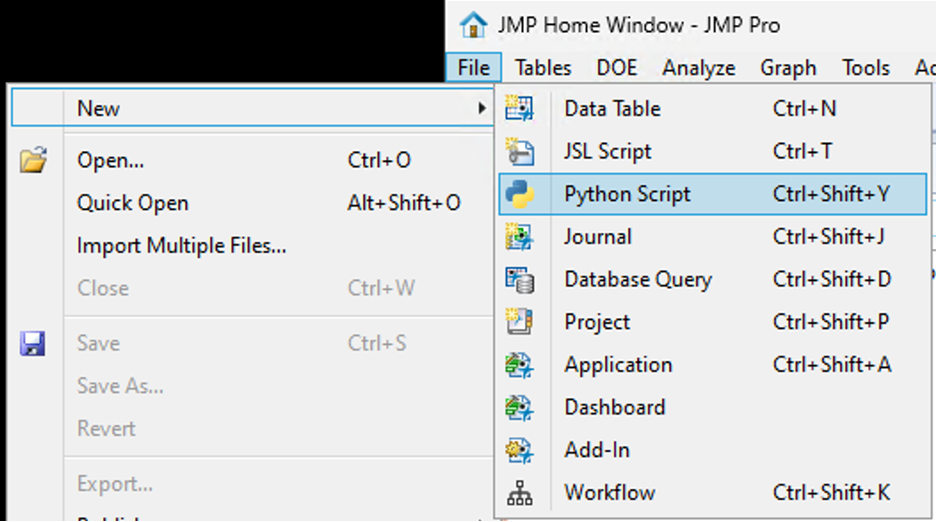

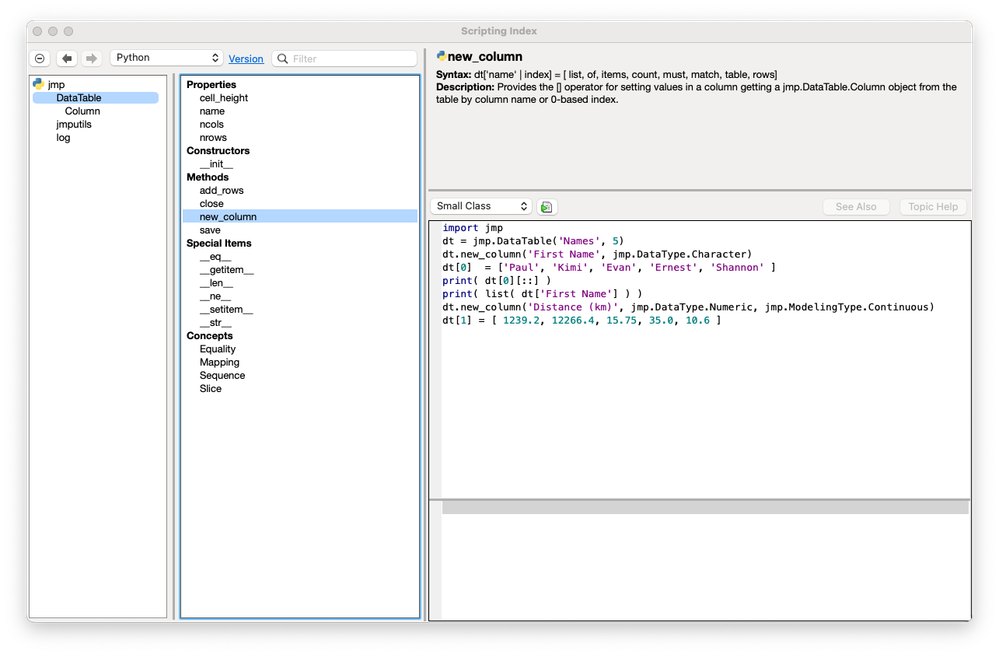

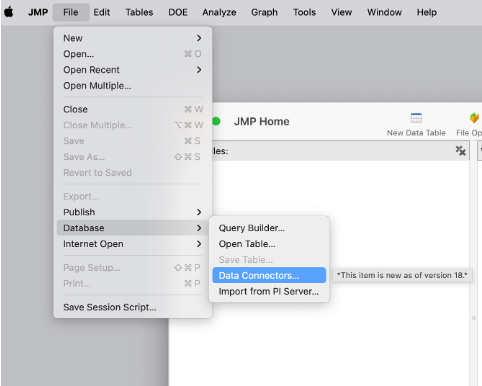

JMP 18 has a new way to integrate with Python. The JMP 18 installation comes with an independent Python environment designed to be used with JMP. In addition, JMP now has a native Python editor and P...

SamGardner

SamGardner

KristenBradford

KristenBradford

Paul_Nelson

Paul_Nelson

Di_Michelson

Di_Michelson

LauraCS

LauraCS

gail_massari

gail_massari Valerie_Nedbal

Valerie_Nedbal

julian

julian

mia_stephens

mia_stephens

dieter_pisot

dieter_pisot

Daniel_Valente

Daniel_Valente

Wendy_Murphrey

Wendy_Murphrey

sseligman

sseligman

MikeD_Anderson

MikeD_Anderson

jordanwalters

jordanwalters