Process analytical technology and JMP

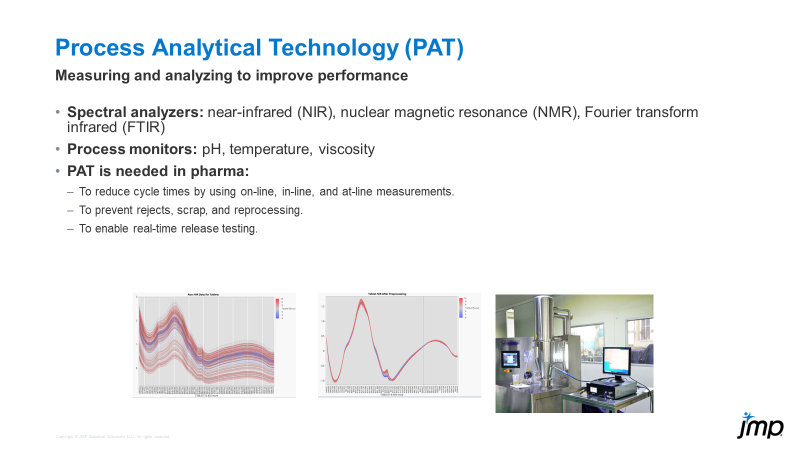

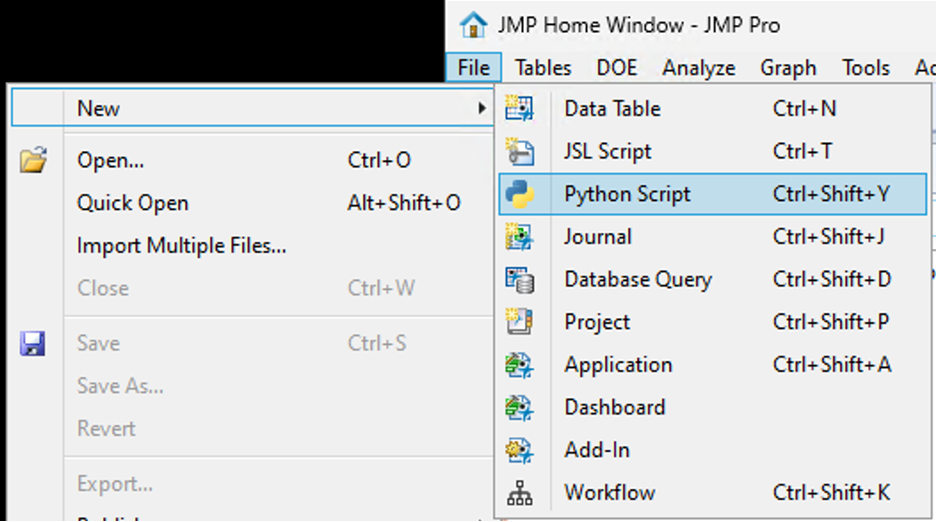

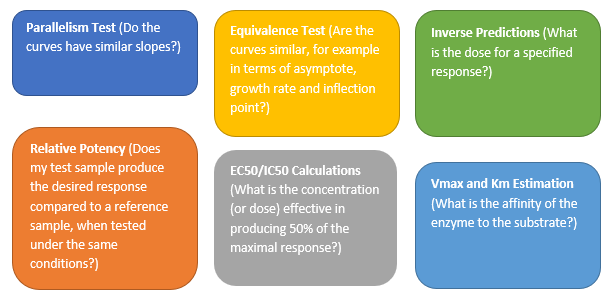

Process analytical technology (PAT) is not new to the world, but it may be a newer concept for many, especially when it comes to using JMP to analyze and process PAT data. PAT can be part of and is o...

Bill_Worley

Bill_Worley

DaeYun_Kim

DaeYun_Kim

SamGardner

SamGardner

gail_massari

gail_massari

Valerie_Nedbal

Valerie_Nedbal

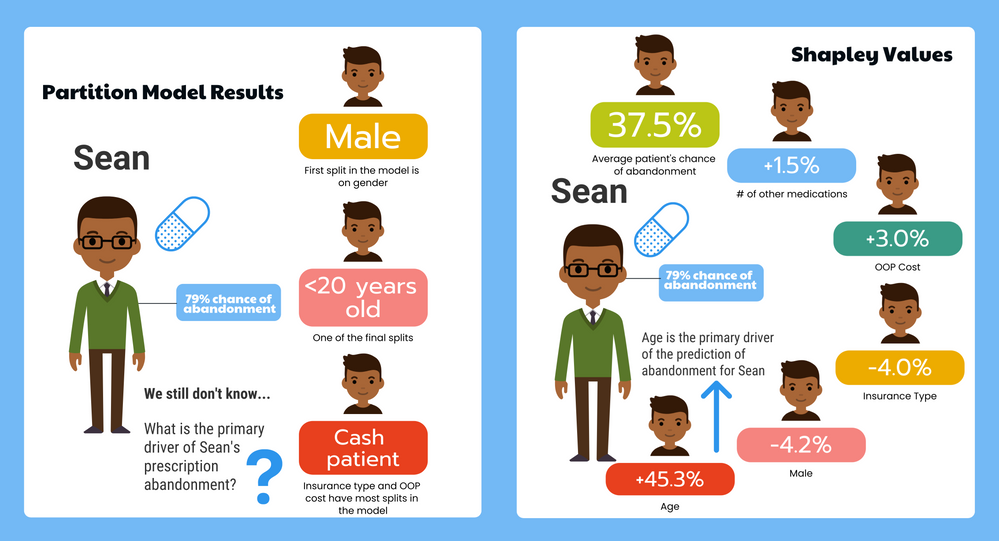

Richard_Zink

Richard_Zink KristenBradford

KristenBradford

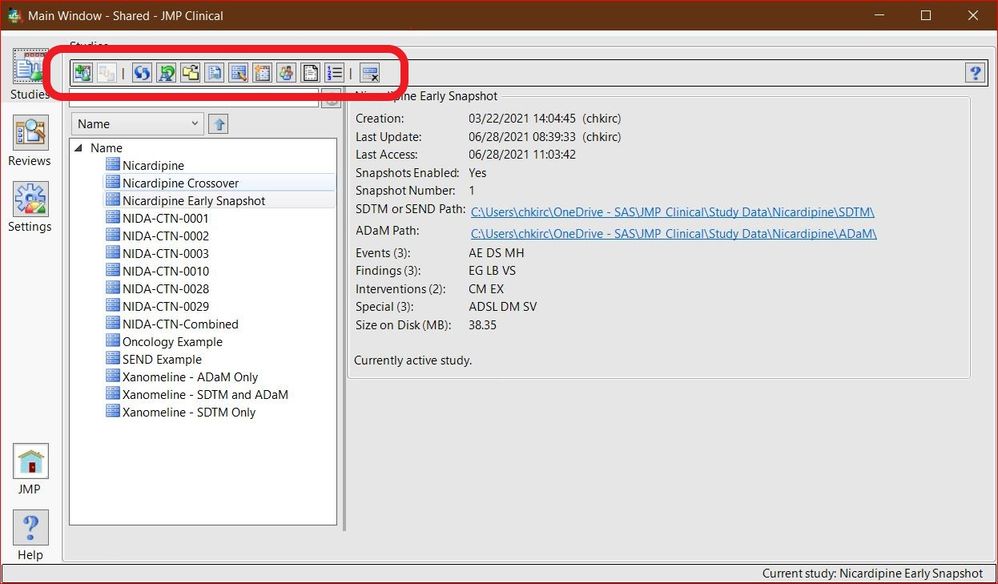

Chris_Kirchberg

Chris_Kirchberg

cweisbart

cweisbart

Paul_Nelson

Paul_Nelson

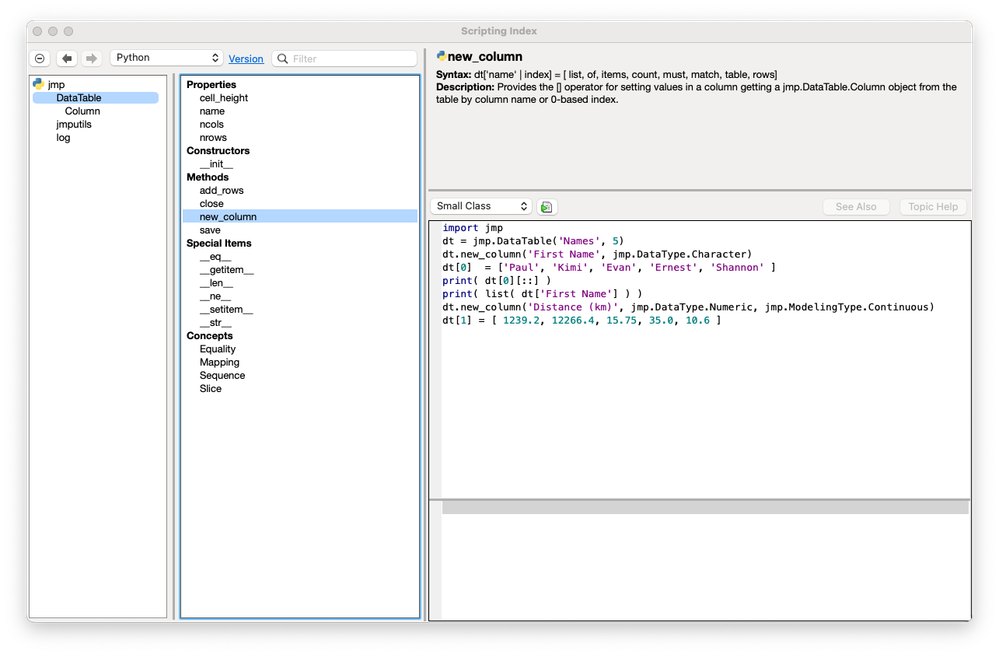

Craige_Hales

Craige_Hales

anne_milley

anne_milley

Di_Michelson

Di_Michelson

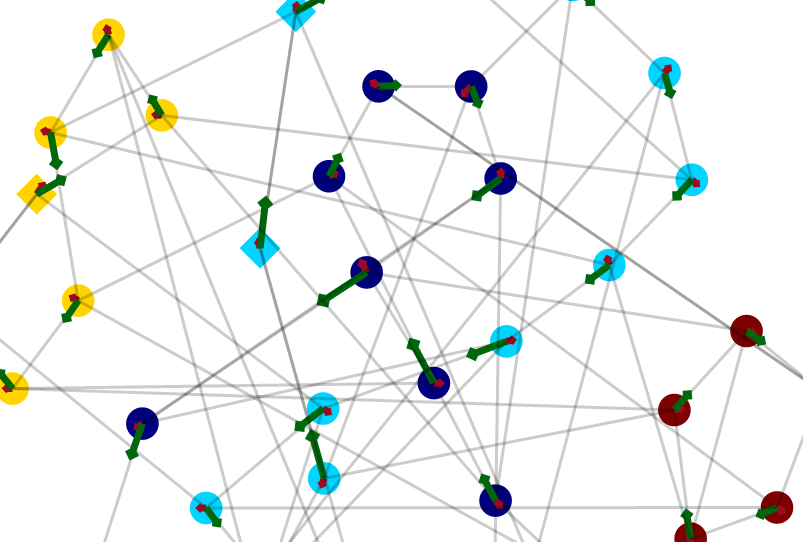

JohnPonte

JohnPonte Masukawa_Nao

Masukawa_Nao

Jed_Campbell

Jed_Campbell LauraCS

LauraCS MarilynWheatley

MarilynWheatley